Tax & Legal Basics

We hope you all had an exciting week planning & developing your MVP and learned a lot about what is really essential for your idea and how you can get started quickly.

Task 1: Present your MVP to at least 2 people/companies and get feedback.

We already mentioned last week that you should ideally charge money for your MVP's performance. This is not mandatory, but it does have some advantages:

You learn immediately whether your customers are willing to spend money on your service. It is always different whether people say in a survey, for example, that they would pay €50 for your service, or whether they actually give you €50. Often they simply don't want to disappoint you in a survey and therefore say what you want to hear.

You get honest feedback: If you offer your service free of charge, your customers are always grateful that you are doing something for them and usually don't mention the points of criticism so as not to make you feel bad. But if, for example, customers have paid €3,000 for a service and were not satisfied with some points or believe that the services were not worth the money, then you will hear about it from them.

By offering services for free, you are destroying your future business model. If you give out your service for free or at a greatly reduced price at the beginning, your customers may no longer be willing to pay for the same service later on because they were able to get it much cheaper (or even for free) before.

In order to bill for a service and write invoices to your customers, you must officially operate a business. Although this formal establishment is always a big step for startups because it brings a certain commitment to ideas and teams, it should not be overly dramatized. Think of it more as a necessary formality that you need to do so that you can properly deal with the tax office and their demands. In the beginning, your main focus should always be on providing a good product or service for the customer and continuously improving it.

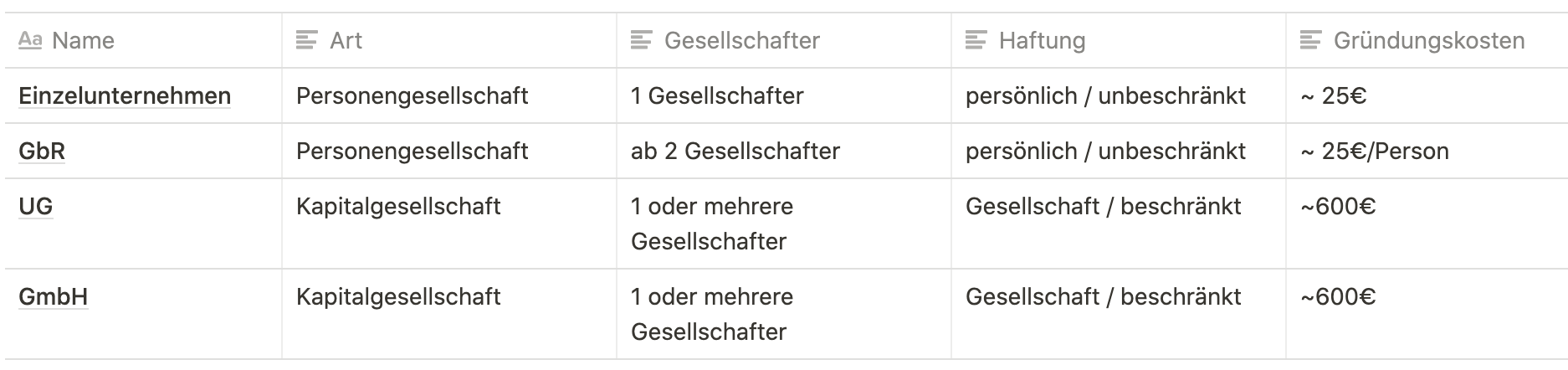

There are many different legal forms for companies in Germany, but for the sake of simplicity we will focus here on the most important ones for start-ups with the intention of making a profit: Einzelunternehmen, Gesellschaft bürgerlichen Rechts (GbR), Unternehmergesellschaft (UG) and Gesellschaft mit beschränkter Haftung (GmbH).

Behind the links on the "For founders" portal you will find a lot more information on the company forms and also more information on the founding process. We'll just briefly go through the basics here to give you an overview:

In general, there is a distinction between a partnership and a corporation. A partnership is suitable for a single founder (sole proprietorship) or an association of several people (GbR). The formation process is simple: you just have to go to the trade office in your city and register as a business. In Kiel, for example, this costs €25 for a sole proprietorship. From the moment you register, you are allowed to operate as a business and write invoices. A sole proprietorship bears your personal name as the company name, a GbR the personal names of the partners (e.g. "Mustermann & Musterfrau GbR"). In the case of a GbR, a GbR partnership agreement can also be concluded between the partners.

A partnership is well suited to starting up quickly and billing services, e.g. programming activities or selling products. The companies are always linked to the owners/partners, profits flow to the partners at the end of the year and must also be declared by them in their own tax returns. Partners in partnerships always have unlimited personal liability with their private assets.

Partnerships that turn over less than €22,000 per year can also make use of the small business regulation, which allows them not to have to declare VAT and thus further reduce the bureaucratic burden in the initial phase. In the case of corporations, you are only liable with the assets of the company and not privately (as long as you do not make any completely negligent mistakes as managing director). These legal forms are also better suited if you want to build up goodwill over the years that is independent of the shareholders and is therefore of interest to venture capitalists/investors, for example.

However, the start-up costs are also many times higher. The most popular form in Germany, the GmbH, requires share capital of €25,000, at least half of which must be paid in when the company is founded.The formation process is very time-consuming (several weeks) and must be notarized, which accounts for the majority of the formation costs in addition to the entry in the commercial register.

The UG can be seen as the little sister of the GmbH and theoretically only requires €1 in share capital. However, you should of course pay in more, as otherwise you will already be insolvent due to the formation costs. However, the UG otherwise has the same advantages as the GmbH. According to the definition, the aim of a UG is to convert it into a GmbH at some point once enough money has been saved. The formation process and costs are almost identical to those of a GmbH.

You can find a more detailed overview of the legal forms at "Für Gründer".

Information on liability: Germans are known for their risk aversion and the first impulse of most founders is to avoid personal liability altogether and set up a corporation right away. Try to weigh up the risk rationally. For most startups, the risk that they will be liable for large sums is very low and therefore it is perfectly fine to start with a partnership or even consider it in the longer term.

Important: For many startup support programs in an early phase, you must not have founded a company yet. For example, for the Schleswig-Holstein start-up grant or Exist. A GbR can usually still be justified there with the purpose of having joined forces to found a company in the future. If you found a corporation beforehand, you disqualify yourself for these funding measures.

Here are some examples of startups from the starterkitchen:

stackOcean: Starting out as a team of four, the team initially focused on developing the product. When they had their first customers for smaller amounts in the hundreds of euros, one of the founders simply set up a sole proprietorship to be able to invoice these sales. As the team was in the process of applying for the start-up grant from the state of Schleswig-Holstein, they were not yet allowed to set up a corporation. When they received the grant for the start-up scholarship, they founded a GmbH with a capital contribution of €12,500 the following month.

Spielköpfe: The three-woman team from the Starterkitchen produces and sells gender-appropriate card games. For the production and sale of the first card games, they founded a GbR, which accounts for production and sales and divides the profits from sales among themselves at the end of the year.

Task 2: Get an overview of possible legal forms.

Task 3: Think about what legal form your company should / could take. You do not have to decide here, but you should be able to justify why you would choose this legal form.

Tasks for this chapter 💪

Weekly Report Template

Last updated